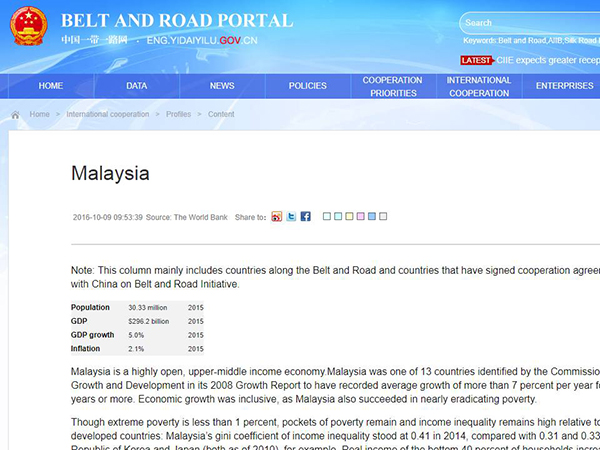

China's Belt and Road portal described Malaysia’s near-term economic outlook in 2016 as "broadly favorable".

China's Belt and Road portal described Malaysia’s near-term economic outlook in 2016 as "broadly favorable".

Malaysia’s New Government, the Belt and Road Initiative, and China

On 5 July 2018, Malaysia’s Ministry of Finance (MoF) instructed contractors delivering three infrastructure projects worth US$22 billion to suspend all works with immediate effect, invoking the ‘national interest’ as its rationale. All three projects are associated with China’s Belt and Road Initiative (BRI), and the announcement followed a month-long campaign by Malaysia’s newly elected Alliance of Hope (PH) government to prepare the Malaysian public for such dramatic action. During this time, Finance Minister Lim Guan Eng had told media sources that the terms of these projects’ contracts made them too expensive for the nation to bear. They exposed Malaysia to ongoing operating deficits well beyond the cost of construction, and in the case of two of these projects, 88% of project fees had already been paid by the previous government despite the delivery of only 13% of the work. ‘We have discovered that the payment schedule[s] for the above contracts are based almost entirely on timeline milestones, and not on progressive work completion milestones’, Finance Minister Lim Guan Eng told the Malaysian media.

The projects in question include the East Coast Rail Link (ECRL), intended to connect southern Thailand and Kota Bharu in the north-eastern Peninsular state of Kelantan with Port Klang on the west coast via the east coast port city of Kuantan, work on which was contracted to a Chinese company, China Communications Construction Co Ltd. The others are oil and gas pipelines, including the Multi Project Pipeline from Malacca on the south-west coast to Jitra in the north-western state of Kedah, and the Trans-Sabah Gas Pipeline connecting Kimanis with Sandakan and Tawau in the eastern Borneo state. Work on these pipelines was contracted to the China Petroleum Pipeline Bureau. Lim’s announcements suggested that the project contracts might have been structured to cover losses associated with the 1MDB government investment fund. According to the United States Department of Justice, 1MDB has been embezzled of at least US$3.5 billion since 2015 or perhaps earlier. Lim expressed this submission openly in relation to two of the projects in Adam Aziz, ‘MoF links two suspicious projects worth Rm9.4b to 1MDB’. To date, and before Najib is brought to trial in Malaysia following charges issued on 4 July, this complex, international scandal is best understood with reference to the Wall Street Journal’s summary of its cache of special reporting and the investigation conducted by the United States Department of Justice. Refer to Bradley Hope et al., ‘Malaysia’s 1MDB scandal: how $1 billion made its way to the prime minister’, although the full total remains unclear. Indeed, so large was the scale of this embezzlement that some accounts have the total cost of the 1MDB ‘Ponzi scheme’ – under investigation in at least six countries due to its international reach – at around US$7 billion. Whatever its true extent, the impact of the scandal is now compounding the new government’s fiscal crisis, including national debt levels of up to US$251 billion, or 80% of gross domestic product, according to some estimates. In the circumstances, and compounded by the structure of their contracts and timelines, these BRI projects suspended by Lim are now bound up with a government campaign to cut excessive government spending associated with public sector corruption.

Circumstances aside, the new government’s tactics in relation to these Chinese projects have placed Malaysia at the centre of Asian debates about the impact of China’s rise in the region and the geopolitical aims of its BRI. It now shares this position with nations such as Sri Lanka, which failed to repay its debts to the Chinese firms responsible for redeveloping its Hambantota port. This failure forced it, under the terms of the project’s contract, to hand the port to China on a 99-year lease in December 2017. Since this handover, a debate has raged in international media, policy, and scholarly circles on the risks the BRI might pose to recipient nations, much of it focused on Chinese strategy and tactics. Such tactics are sometimes thought to include ‘debt-trap diplomacy’, aimed at capturing strategic assets such as ports by debt-financing projects on repayment terms that recipient nations cannot service. According to this line of argument, such nations presumably sign on to these risky contracts because they are driven to do so under conditions of internal crisis. Pakistan, too, is another case, and its recent election, won by former cricketer Imran Khan, has focused debate on Chinese loans and the nation’s balance of payments crisis which raises doubts about its capacity to repay. In any case, despite its leader’s criticisms that China could impose a ‘new colonialism’ by imposing unserviceable debts on smaller nations, Malaysia has been careful not to give the impression that it is rejecting Chinese projects per se. Rather, the Malaysian government is careful to spell out that it favours projects that bring new technologies to Malaysia to create jobs and support its economic reforms, while it also searches for new opportunities to export high-value products to China. Prime Minister Mahathir Mohamad’s trip to China in August 2018 was a significant investment by both nations in their bilateral relationship, although it appears for now that negotiations to scrap the projects have not yet concluded successfully.

Nevertheless, in assigning so much weight to this visit, China has communicated that it views Malaysia as an important linchpin to its BRI plans, and that it intends to prioritise its Malaysian contracts in light of its election and transfer of power. China appears aware that Malaysia’s election, like Pakistan’s, has brought to the forefront of national and international debate questions of debt and risk for small and medium powers in a changing regional order. Indeed, it would have been difficult to miss this debate gathering momentum in Malaysia, or the new government’s role in stimulating it both before and after the election.

Amrita Malhi is with the Department of Political and Social Change, Australian National University, Canberra, Australia.